On May 7, 2020, the Company changed the Administrative agent of its Credit Facility from Cadence Bank, N.A. to Wells Fargo Bank, N.A.

On October 9, 2020, the Company further amended the Credit Facility to provide for (i) up to $302.6 million aggregate principal amount of commitments available for borrowing until the Revolving Facility Maturity Date with (ii) up to an additional $70.0 million accordion available for borrowing until the Revolving Facility Maturity Date.

As of December 31, 2020, the Company had $297.0 million in borrowings and $0.15 million in letter of credits under the Credit Facility outstanding with $5.5 million in revolving commitments available. As of December 31, 2019, the Company had $220.0 million in borrowings and $0 in letter of credits under the Credit Facility outstanding.

Borrowings under the Credit Facility bear interest at either the Alternate Base Rate (“ABR”) for ABR borrowings or the Adjusted LIBO rate for Eurodollar borrowings. As defined by the Senior Secured Revolving Facility, the ABR is the rate equal to the greatest of (a) prime rate, (b) 0.05% plus the greater of the (i) Federal funds effective rate or (ii) the overnight bank funding rate, or (c) London Interbank Offered Rate (“LIBOR”) multiplied by the statutory reserve rate. The Adjusted LIBOR Rate is multiplied by the statutory reserve rate. Prior to the April 7, 2020 amendment, depending on the Company’s leverage ratio, the applicable margin ranges from 1.25% to 2.25% for ABR borrowings or 2.25% to 3.25% for Eurodollar borrowings. Following the April 7, 2020 amendment, depending on the Company’s leverage ratio, the applicable margin ranges from 1.75% to 2.75% for ABR borrowings or 2.75% to 3.75% for Eurodollar borrowings. During the continuance of an event of default, overdue amounts under the Credit Facility will bear interest at the highest applicable interest rate depending on the type of borrowing.

The Credit Facility contains representations, warranties and covenants that are customary for similar credit arrangements, including, among other things, covenants relating to (i) financial reporting and notification, (ii) payment of obligations, (iii) compliance with applicable laws, (iv) notification of certain events and (v) solvency. The Credit Facility is secured on a first priority basis (subject only to permitted liens) by substantially all of the Company’s assets.

The Credit Facility contains certain covenants, restrictions and events of default including, but not limited to, a change of control restriction and limitations on the Company’s ability to (i) incur indebtedness, (ii) issue preferred equity, (iii) pay dividends or make other distributions, (iv) prepay, redeem or repurchase certain debt, (v) make loans and investments, (vi) sell assets, (vii) acquire assets, (viii) incur liens, (ix) enter into transactions with affiliates, (x) consolidate or merge and (xi) enter into hedging transactions.

The Credit Facility requires the Company to maintain ratios of indebtedness to EBITDA of not more than 4.25 to 1.00 thereafter. For purpose of these tests, it is subtracted from indebtedness an amount not to exceed $15.0 million of unrestricted cash and cash equivalents of the Company and its subsidiaries. EBITDA, as defined in the Credit Facility, excludes non-cash items and any extraordinary, unusual or non-recurring gains, losses or expenses. In addition, the Credit Facility also requires the Company to maintain ratios of EBITDA to total interest expense accrued on indebtedness of the Company and its subsidiaries of not less than 2.50 to 1.00. At December 31, 2020, the Company was in compliance with all covenants contained in the Credit Facility.

10. Redeemable preferred units

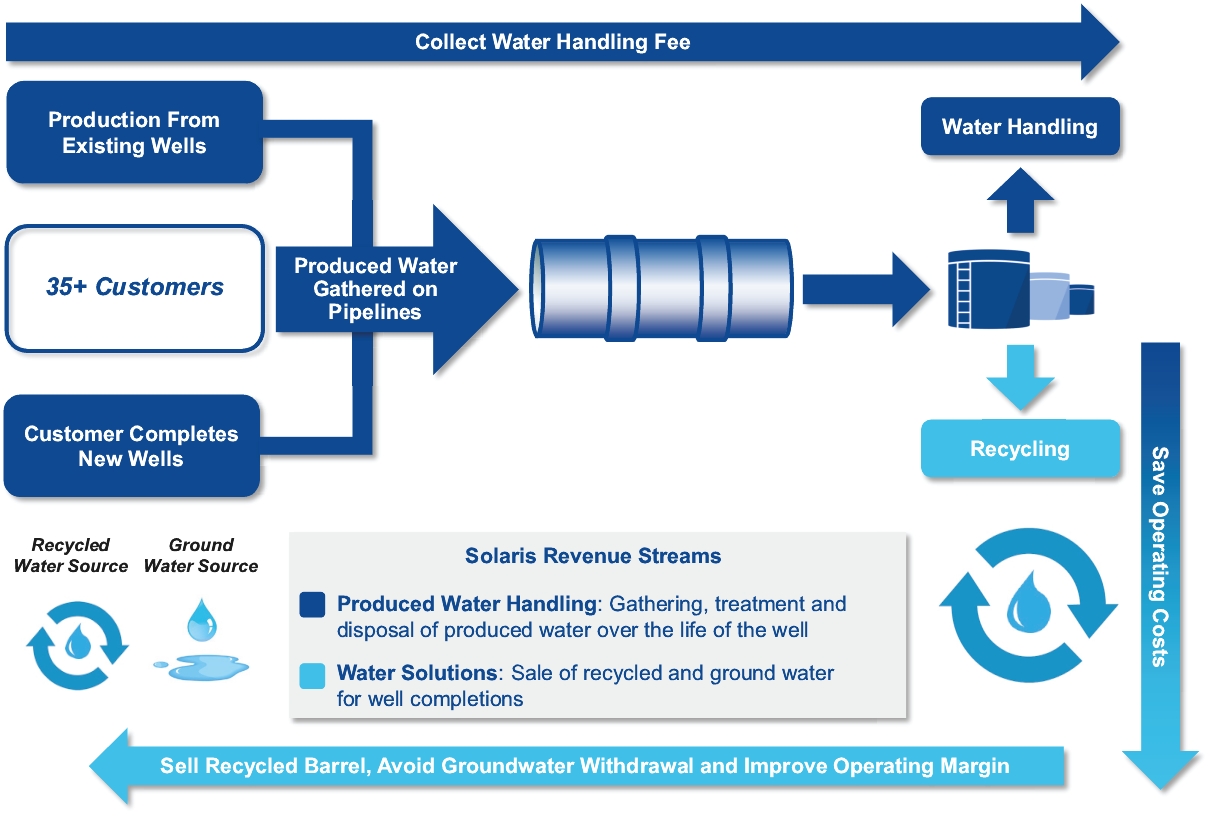

On June 11, 2020, the Company issued 7,500 Redeemable Preferred Units (the “Preferred Units”) to Concho as part of the consideration to acquire certain produced water handling, transportation and water disposal assets in Lea County, New Mexico. Concho has the option to convert the Preferred Units into Class A Units by way of exchange to satisfy current and any future cash capital commitments. The Preferred Units to be exchanged are valued at the Preferred Unit Liquidation Value in exchange for Class A Units valued at $10.00 per Class A Unit. “Preferred Unit Liquidation Value” means, with respect to each Preferred Unit, the sum of (a) the Preferred Unit Amount with respect to such Preferred Unit, plus (b) the amount of all cash distributions (including any preferred default distributions) accrued and unpaid with respect to such Preferred Unit, in each case, as of the time of determination. As of the date of issuance, Concho’s cash capital commitment was $5.6 million.