Aris Water Solutions, Inc.

9811 Katy Freeway, Suite 700

Houston, TX 77024

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

June 8, 2022

9:00 a.m. Central Time

9811 Katy Freeway, Suite 700, Houston, Texas 77024

To Our Stockholders:

Aris Water Solutions, Inc. (the “Company”) will hold the 2022 Annual Meeting of Stockholders (the “Annual Meeting”) on Wednesday, June 8, 2022, at 9:00 a.m. Central Time at 9811 Katy Freeway, Suite 700, Houston, Texas 77024.

The Annual Meeting will be held for the following purposes:

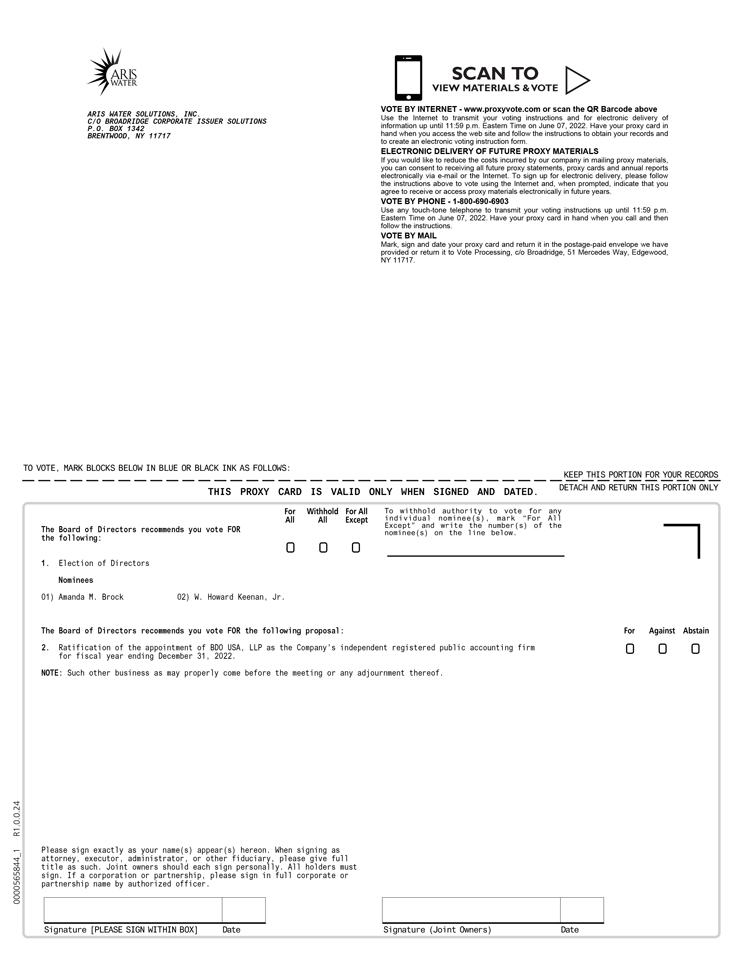

1. To elect two Class I Directors, the names of whom are set forth in the accompanying proxy statement, to serve until the 2025 Annual Meeting of Stockholders.

2. To hold an advisory vote to ratify the appointment of BDO USA, LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2022.

3. To transact any other business that may be properly presented at the Annual Meeting.

Stockholders of record as of 5:00 p.m. Eastern Time on Wednesday, April 13, 2022 will be entitled to notice of, and to vote at, the Annual Meeting, or any adjournment thereof. The Proxy Statement and related proxy materials are first being released to the Company’s stockholders and made available on the internet on or about Tuesday, April 26, 2022.

We encourage you to review these proxy materials and vote your shares before the Annual Meeting.

By Order of the Board of Directors,

Adrian Milton

General Counsel, Chief Administrative Officer and Corporate Secretary

Houston, Texas

April 26, 2022

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON JUNE 8, 2022

The notice, proxy statement and 2021 Annual Report on Form 10-K are available at www.proxyvote.com.